All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Multi-year guaranteed annuities, additionally recognized as MYGAs, are dealt with annuities that lock in a secure rates of interest for a specified period. Surrender durations usually last three to one decade. Due to the fact that MYGA prices change daily, RetireGuide and its companions update the complying with tables below regularly. It's vital to check back for the most current information.

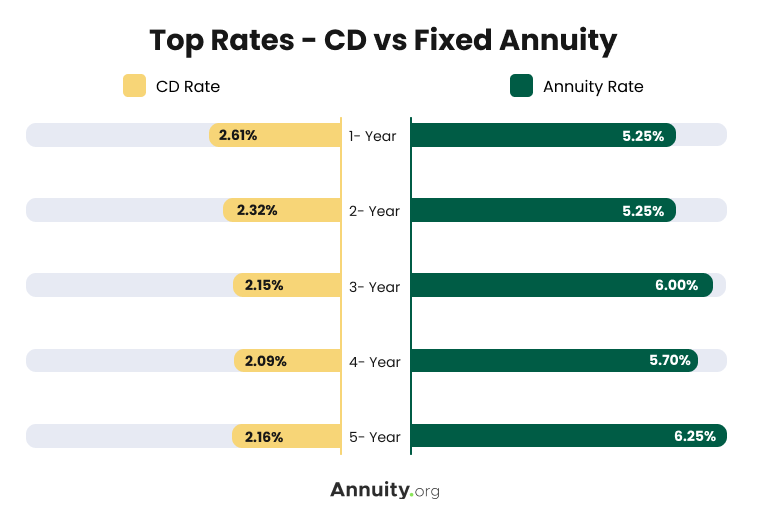

Numerous factors establish the price you'll get on an annuity. Annuity prices often tend to be higher when the basic level of all rate of interest is greater. When purchasing taken care of annuity rates, you could locate it handy to compare rates to deposit slips (CDs), one more prominent choice for safe, trusted development.

In basic, fixed annuity prices surpass the rates for CDs of a similar term. Other than earning a higher rate, a repaired annuity may offer much better returns than a CD because annuities have the advantage of tax-deferred growth. This suggests you will not pay tax obligations on the passion earned up until you start getting settlements from the annuity, unlike CD rate of interest, which is counted as gross income annually it's earned.

This led many professionals to think that the Fed would lower prices in 2024. Nevertheless, at a policy online forum in April 2024, Federal Reserve chair Jerome Powell suggested that prices might not come down for some time. Powell claimed that the Fed isn't sure when rate of interest cuts could occur, as inflation has yet to be up to the Fed's benchmark of 2%.

Genworth Life Annuity Insurance Company

Keep in mind that the best annuity prices today might be various tomorrow. Begin with a free annuity appointment to find out exactly how annuities can assist fund your retirement.: Clicking will take you to our partner Annuity.org.

Think about the kind of annuity. A 4-year fixed annuity might have a greater rate than a 10-year multi-year ensured annuity (MYGA).

The guarantee on an annuity is only just as good as the company that issues it. If the firm you purchase your annuity from goes broke or bust, you might shed cash. Check a business's financial strength by getting in touch with nationally identified unbiased ranking companies, like AM Ideal. Many specialists advise just taking into consideration insurance providers with a score of A- or over for long-term annuities.

Annuity earnings rises with the age of the purchaser because the earnings will be paid out in fewer years, according to the Social Protection Administration. Don't be stunned if your price is higher or lower than another person's, even if it's the exact same item. Annuity rates are simply one aspect to consider when getting an annuity.

Comprehend the costs you'll have to pay to administer your annuity and if you need to pay it out. Squandering can set you back as much as 10% of the value of your annuity, according to the Wisconsin Office of the Commissioner of Insurance policy. On the other hand, administrative charges can include up with time.

Allstate Fixed Annuities

Rising cost of living Rising cost of living can consume up your annuity's worth over time. You can consider an inflation-adjusted annuity that improves the payouts in time. Understand, though, that it will dramatically lower your preliminary payouts. This implies much less money early in retirement but even more as you age. Take our free test & in 3 simple steps.

Check today's lists of the finest Multi-year Guaranteed Annuities - MYGAs (upgraded Thursday, 2025-03-06). For professional aid with multi-year ensured annuities call 800-872-6684 or click a 'Get My Quote' button following to any type of annuity in these checklists.

Delayed annuities enable a quantity to be withdrawn penalty-free. Deferred annuities normally permit either penalty-free withdrawals of your gained rate of interest, or penalty-free withdrawals of 10% of your agreement value each year.

The earlier in the annuity period, the greater the charge percent, described as abandonment charges. That's one reason that it's best to stick to the annuity, when you dedicate to it. You can take out everything to reinvest it, yet before you do, make certain that you'll still prevail by doing this, also after you figure in the abandonment cost.

The surrender cost could be as high as 10% if you surrender your contract in the first year. An abandonment charge would certainly be billed to any type of withdrawal better than the penalty-free amount enabled by your delayed annuity agreement.

You can establish up "systematic withdrawals" from your annuity. Your various other alternative is to "annuitize" your delayed annuity.

Nationwide Variable Annuity

This opens a range of payout alternatives, such as revenue over a single lifetime, joint lifetime, or for a given period of years. Lots of deferred annuities enable you to annuitize your agreement after the initial agreement year. A significant distinction remains in the tax obligation treatment of these items. Interest gained on CDs is taxable at the end of every year (unless the CD is held within tax obligation competent account like an IRA).

The rate of interest is not tired till it is gotten rid of from the annuity. To put it simply, your annuity grows tax deferred and the passion is compounded yearly. Comparison buying is always an excellent concept. It holds true that CDs are guaranteed by the FDIC. MYGAs are insured by the specific states normally, in the variety of $100,000 to $500,000.

Borrowing Against Annuity

Either you take your cash in a lump sum, reinvest it in another annuity, or you can annuitize your agreement, transforming the lump amount right into a stream of income. By annuitizing, you will just pay taxes on the passion you obtain in each repayment.

These functions can differ from company-to-company, so be certain to explore your annuity's fatality advantage features. There are numerous benefits. 1. A MYGA can indicate reduced tax obligations than a CD. With a CD, the interest you earn is taxed when you earn it, despite the fact that you do not get it until the CD grows.

So at the minimum, you pay tax obligations later, instead of faster. Not just that, however the compounding passion will certainly be based upon a quantity that has actually not already been taxed. 2. Your beneficiaries will certainly get the full account value since the date you dieand no surrender fees will certainly be deducted.

Your recipients can pick either to get the payout in a lump amount, or in a series of earnings settlements. 3. Typically, when someone dies, also if he left a will, a judge determines who gets what from the estate as occasionally relatives will certainly argue regarding what the will certainly methods.

With a multi-year set annuity, the owner has actually plainly assigned a recipient, so no probate is needed. If you contribute to an IRA or a 401(k) plan, you obtain tax deferment on the profits, simply like a MYGA.

Latest Posts

Mass Laborers Annuity Fund

Transamerica Annuity Calculator

Great West Life And Annuity Phone Number